The challenges

Core limitations

Legacy core technology is often poorly documented and proves difficult to integrate with internal and third-party solutions.

Data silos

Valuable customer data is stored in multiple systems, making it challenging to provide comprehensive insights to launch new products and services quickly.

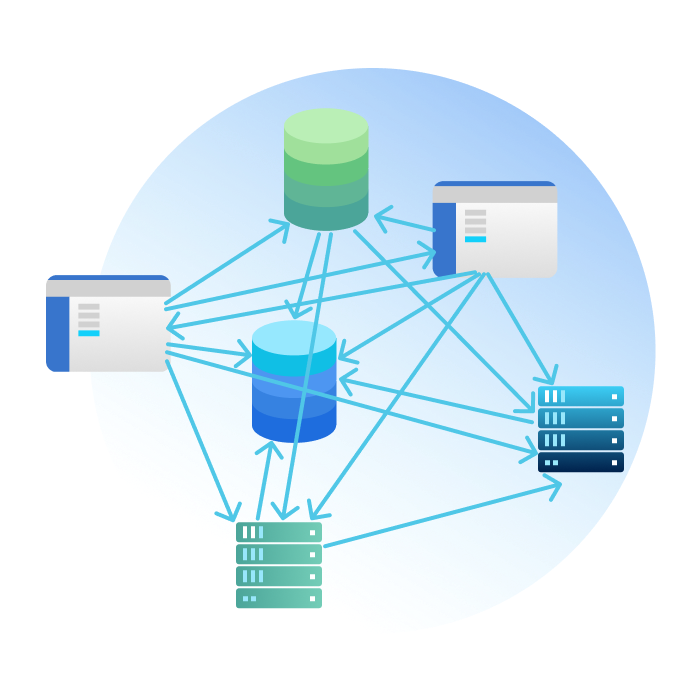

Unmanageable IT landscape

Decades of ad-hoc accumulation of legacy systems result in a brittle point-to-point architecture.

Vendor dependence

Many vendors provide basic systems and services that come with onerous contracts and a sluggish roadmap.

Resource constraints

It is difficult to utilize the few available IT resources for anything other than custom development and maintenance.

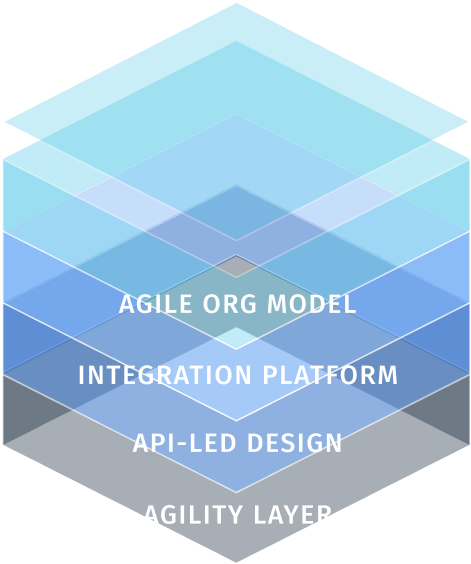

Our delivery methodology

Agility layer

Implement an API agility layer to enable reuse and legacy modernization.

Integration platform

Leverage the integration platform that suits your needs, budget, and resources.

Best practices

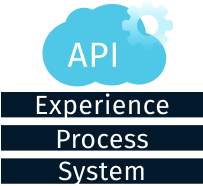

API-led design

Build the agility layer with APIs that are modular, discoverable, and reusable.

Agile org model

Establish a new operating model to scale by building and leveraging reusable APIs.

Approach

Our collaborative approach leverages API-led and Agile best practices, building on insights derived from our most successful customers.

Discovery & planning

Understand your challenges, goals, and use cases, to align on a path forward.

Agile delivery

Organize and deliver the work following agile best practices.

Enablement & ownership

Progressively enable your team to become autonomous and take ownership of the solution.

Training and support

Jointly develop your training and support models.

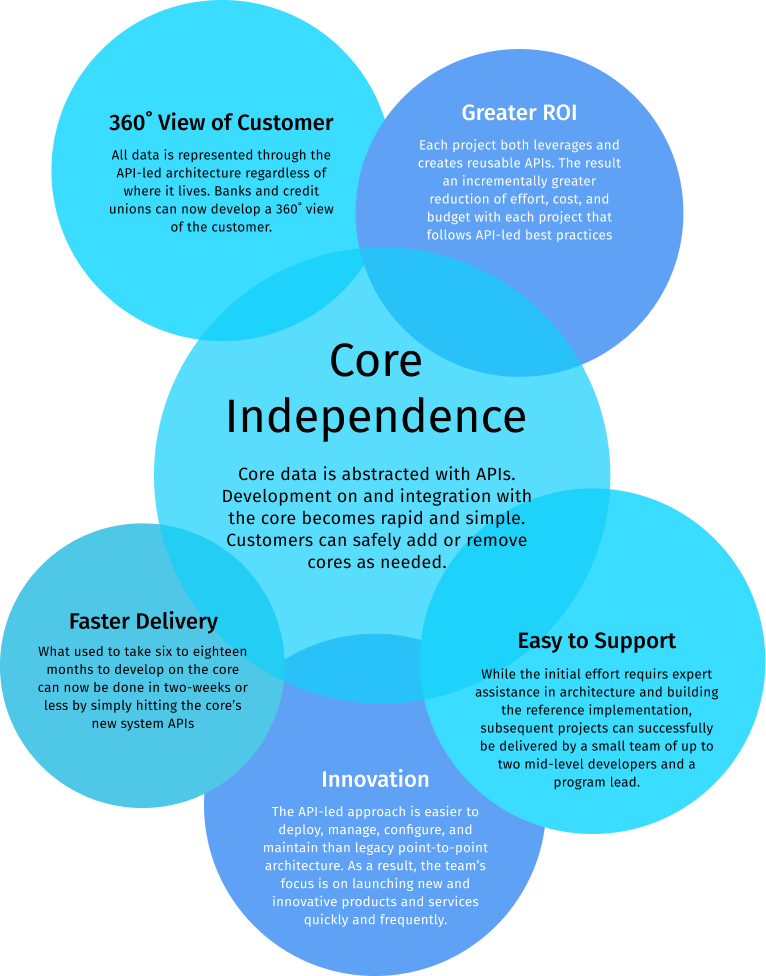

Outcomes

Transforming our financial services customers from maintenance mode to innovation shops.

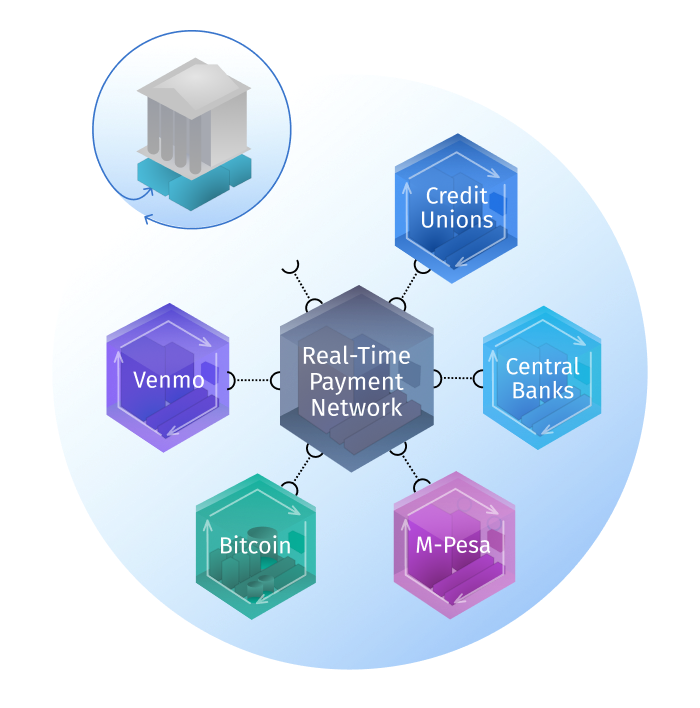

Bank and Credit Union integration use cases

Bank and Credit Union integration use cases

Modern integration is at the heart of our solutions. Below, are integrations that followed the API-led practices described above to provide independence from core vendors for our customers. In each case, the customer is able to leverage reusable APIs developed during these engagements to integrate other internal and external systems.

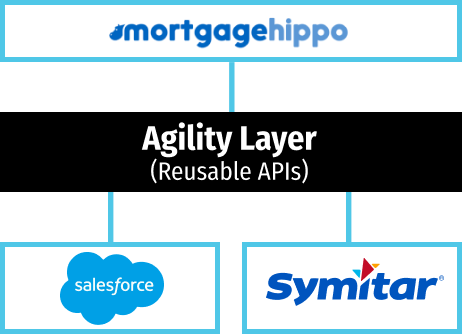

SalesForce, Mortgage Hippo, and Symitar:

Automated lead management and personal loan sales campaigns by integrating the Symitar core banking system (Customer System of Record), SalesForce (Campaign Engine), and Mortgage Hippo (Mortgage Leads) for a regional Credit Union.

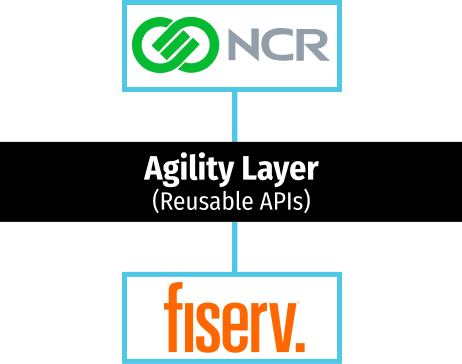

NCR Digital Banking and Fiserv:

Partnered with a regional consumer bank to replace a home-grown web banking application with NCR’s Digital Banking (formerly Digital Insight). Leveraged the MuleSoft Anypoint platform and API-led approach to integrate with Fiserv Premier core banking systems. Subsequently extended the integration to include other components of the customer’s IT landscape.

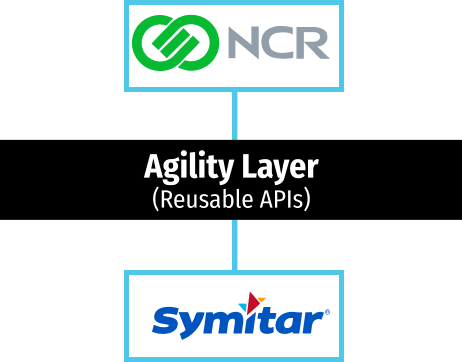

NCR Digital Banking and Symitar:

Implemented the MuleSoft Anypoint platform and used the API-led approach to deliver an integration solution between NCR’s Digital Banking (formerly Digital Insight) and Symitar core banking system for a major Washington State (US) credit union. Subsequently extended the integration to include other components of the customer’s IT landscape.

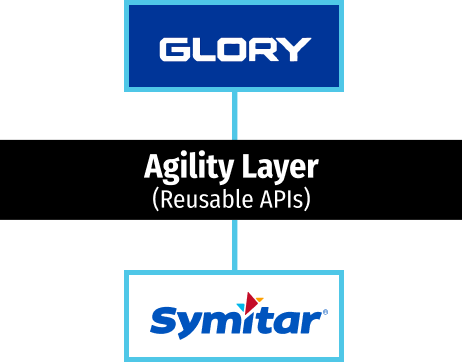

Glory Teller Cash Recyclers with Symitar:

Implemented an API-led solution that leveraged existing customer APIs and the MuleSoft Anypoint platform to achieve interoperability between Glory’s Teller Cash application system and Symitar core banking system to support real-time cash withdrawal and deposit transactions for a major Pacific Northwest (US) credit union.

MeridianLink and Finastra Phoenix:

Worked with a US regional credit union to implement the MuleSoft Anypoint platform and integrate its Microsoft-based Phoenix core banking software with new cloud-based banking applications such as MeridinanLink’s LoansPQ loan origination product.

Questions? Start a conversation.