Part of ModusBox’s mission is providing access to “reimagined financial services.” These are products and services that have been purpose-built to drive financial inclusion. Unfortunately, in my line of work, I experience conflicting viewpoints over the meaning of financial inclusion. So, I’d like to take this opportunity to “reimagine” what financial inclusion means to me.

Financial inclusion reimagined

Let’s start with how the industry defines financial inclusion. The World Bank and other international development organizations have centered around this meaning:

“Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, and insurance – delivered in a responsible and sustainable way.”1

I think this is a good, complete definition. It works. It feels nice. The problem I run into is that it was written to make everyone happy. And, since it is not my primary objective to make everyone happy, I’ve started using the following definition, which I find to be clearer and more actionable:

“Financial inclusion is equitable access and usage of safe and connected savings, credit, insurance, and payments.”

I prefer this definition because it focuses on the service that the client receives, not the service that FIs intend to provide. For example, “safe” defines the client’s product while in the World Bank’s definition above, “responsible” defines the institution’s product. While this may seem like a subtle difference, it’s ultra-important because it holds practitioners accountable for the positive or negative impact they have on clients.

Likewise, I focus on the meaning of two other words in this definition – equitable and connected.

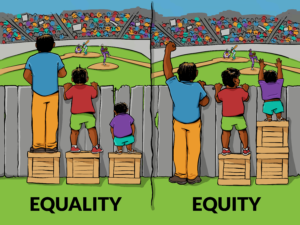

Equitable

“Equitable” focuses on the equality of the results achieved by the client using a product rather than the equality of access to the product. The same product can provide widely varying results to different clients, particularly when those products are designed in the “big city” (or abroad) and delivered digitally.

We believe that small local financial institutions (like MFIs and cooperatives) are crucial for equitable financial services. They are part of the client’s community, which means they understand client needs and are accountable for client success. Therefore, they tend to build products tailored to their client’s success. Most importantly, they provide a human touch.

For the underbanked and newly banked, who are often the most skeptical of digital finance and the most vulnerable to predatory digital lenders, the ability to communicate with a human is essential.

Connected

“Connected” products are required to reduce the cost for clients to move between different financial services. Most of us who have banks know that it’s easy to pay off a credit card from our savings or have a loan deposited into our current account so that we can purchase what we need.

Now, imagine you are a small business owner who was just approved for a loan from your bank to make improvements to your storefront. A new sign, some minor construction, and a good paint job. Exciting! But instead of that money being deposited into your checking account, you are required to pick it up at the bank in cash. Depending on your proximity to the bank, this could present itself as a minor inconvenience or a significant challenge. However, the situation turns dire when your three contractors inform you that they do not accept cash. Your options are either obtaining a cashier’s check or depositing the cash from your bank and making a transfer from a new institution. You would probably drop your bank.

Sadly, this is the situation for most of the world’s underbanked micro-entrepreneurs. They have access to safe loans from MFIs, transactions from mobile money operators, and they likely save their money in cash or illiquid assets like gold. However, they pay a “poverty tax” when moving money between these services.

So, why don’t we just connect all of those services?

The quick answer is that the global payment system was designed by big banks for the benefit of big banks and their high-income customers. Stay tuned for more on that topic.

What’s next?

At ModusBox, we are driving financial inclusion that is equitable, safe, and connected. Real-time push payment networks are rewriting the protocols for how payments work. During this time, we can either stand by as the digital divide between the rich and poor continues to widen or choose to design an equitable system by including small financial institutions alongside their big bank peers as an equal in the new payments regime.

In my next blog, I’ll share my thoughts on fostering successful MFI participation in real-time payments and what our world might look like when we do. If you’d like a sneak peek, check out our work with MFIs in Myanmar or my personal experience with the growth of RTPs in rural parts of India.

If you work with payments and MFIs and this definition of financial inclusion resonated, please send me a note or start a conversation below. I’d love to hear your thoughts!