Transaction fees. Processing fees. Wiring fees.

We’ve all seen the “minimum purchase with credit card” sign at the local restaurant, gas station, or any other business that offers low-cost, low-margin goods. Have you ever asked yourself why these signs exist? Fees. Shop owners cover the cost of transaction fees by requiring a minimum amount for your purchase. Otherwise, did you bring cash?

It’s easy to write off this inconvenience as a “cost of doing business.” For most of the world, the effects of these fees are relatively unnoticeable. Shockingly, however, these “costs of doing business” are a main reason that approximately 2 billion people around the world are excluded from accessing basic financial services that could enable their livelihoods. For those in the bottom of the economic pyramid (BoP), the fees charged by traditional credit/debit cards or point-of-sale devices make it too expensive to send, receive, or use money.

I’ve seen the effects of this first hand throughout my career from Asia to Africa, Europe to North America. Without access to basic financial services, individuals can’t purchase essential goods and services such as education, healthcare, nutrition, e-commerce, clean energy, water, sanitation products, and more.

In an era with more digital payment services and currencies than ever before, all aimed to make our lives more convenient, why is this still a global issue? And, what are we doing about it?

Fees Exist Due to Closed-Loop, Disconnected Financial Systems

Would it surprise you to learn that most of the world’s financial systems (e.g. banks, credit unions, micro-finance, mobile money, etc.) run on 30-year-old core banking technology? In fact, in some cases, it can be up to 50 years old! At the time of its inception, this technology launched the banking industry into the future. Today, these dinosaur banking cores fundamentally cripple financial institutions during a time in which consumers are demanding digital financial products and services at a faster pace than ever before.

This has resulted in financial institutions existing as isolated, closed-loop systems. Practically speaking, this means that individuals who use financial institution ‘A’ can only send, receive, or use money with other individuals or businesses that use financial institution ‘A’. Now, what happens when I, who use financial institution ‘A’, want to transact with any member of financial institution ‘B’? Yep, you guessed it, a transaction, processing, or wiring fee.

In this example, the two financial systems do not interoperate. In other words, they can’t “talk to one another.” This makes sending data (in this case financial data) between the two very difficult – let alone the clearing and settling of cash. This challenge – moving money from one network to another – presents an opportunity that has been exploited for decades.

Enter the Middleman

Over time, an entire industry has manifested itself to broker the sending and receiving of financial data via international bank account numbers or secure messaging protocols. This industry acts as the intermediary ‘mesh’ between the world’s financial systems. Naturally, these middlemen were created to service demand with business models to make money and sustain operations.

The good news is that today, there are new digital technologies entering the market to offer faster, efficient, and more transparent financial services with lower transaction, processing, or wiring fees. However, this alone still does not solve the issue.

Digital Banking Provides Solutions – Albeit Disconnected

Look in any corner of the globe and you’ll find an accelerating trend – the move to digital banking.

From mobile wallet systems such as M-Pesa in Kenya to AliPay in China, Venmo in the US to Recarga Pay in Brazil, there has been a rapid proliferation of digital wallet systems that enable easy, efficient, and instantaneous transfers of funds. We are also witnessing the rise of digital banks, also known as “challenger banks”, that are capturing market share by offering streamlined digital financial services. Further, we’re seeing the rise of third party payment providers like Google Pay, Facebook Pay, Apple Pay, etc.

So, what does this all mean? For starters, it is now easier to send, receive, and use money than ever before. However, these systems often act as over-the-top digital solutions to a rat’s nest of a financial system. While these digital systems are growing in popularity and usage, they are, still, inherently closed-loop systems. Albeit, now, with digital APIs/endpoints that can facilitate an easier point-to-point integration (i.e. one system integrating with another system).

Thus, we find ourselves living in a world with many API/endpoints and digital systems that still struggle to simultaneously integrate with other digital platforms and monies. More importantly, these digital systems struggle to connect to the larger or national level payment switches, as these typically run on legacy payment technologies from the 1980’s. This lack of omni-channel integration hinders true interoperability of financial systems.

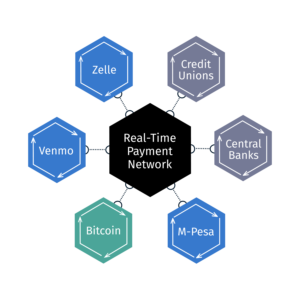

Connecting the World’s Financial Systems for Real-Time Use of Money

With the advent of real-time payment networks (RTPNs) and related software, there now exists technology that serves as the connective tissue between closed-loop financial systems and digital APIs/endpoints. RTPNs and this connective layer enable interoperability among financial institutions, providing these systems the ability to finally “talk” to one another. Today, the best example of this is India’s Unified Payments Interface (UPI) which launched in 2016. Today, the new national payment system supports over 800 million monthly transactions. In 2016, that number was only 93,000.

RTPNs are the last step needed to remove the inherent costs from the financial system because it renders the transaction intermediaries obsolete (at least under their current operating model). This real-time connectivity enables people and institutions to seamlessly send, receive, and use money anywhere, anytime, with anyone – instantly.

A Real-World Scenario

Today, whether you ask a fruit vendor in Africa or a local store owner in the US to accept a credit card or digital payment for a small purchase, you would likely be met with an emphatic “No” or, at least, a politely written sign that expresses as much. And, who’s to blame them? It costs the vendor a significant setup charge to obtain the required point-of-sale hardware device, coupled with high transaction fees per purchase for such low-cost, low-margin items. Further, even if they did accept this form of payment, funds would settle in their bank account approximately two days later, due to the batch processing model of today’s ACH systems. All things considered, many cannot afford to offer these forms of digital payment.

At ModusBox, we are diligently working toward a future in which the global economy runs on Real-Time Payment Networks designed and built to interoperate with other payment systems. By doing so, we can remove the inherent costs that currently exist in the financial system. Imagine if you could walk up to that same vendor and, assuming they have at least a mobile phone, instantaneously pay the merchant for a piece of fruit or a pack of gum and the money would clear and settle in the merchant’s account in real-time.

Your Money Shouldn’t Cost You

Next time you send, receive, or attempt a digital transaction, ask yourself, “Why do I pay this fee?” We believe that with the accelerating movement to digital banking and RTPNs, the inherent costs of the financial system will evaporate and new, digital financial structures will incentivize financial institutions to compete on the basis of new service provision, rather than rent seeking.

More than that, we believe that by removing fees considered by much of the world to be just a “cost of doing business,” great strides can be made towards true financial inclusion. Thanks to the success of India’s UPI, it’s easier to imagine a world where everyone can access services and easily send, receive, and use their money without it costing them their livelihood.

Join the mission or learn more via our Real-Time Payment Networks page. Additionally, you can read about our work with the Bill and Melinda Gates Foundation and the development of Mojaloop – the world’s first open source platform for interoperability among real-time payment networks.